Fourth Quarter Market Update

for North Tacoma

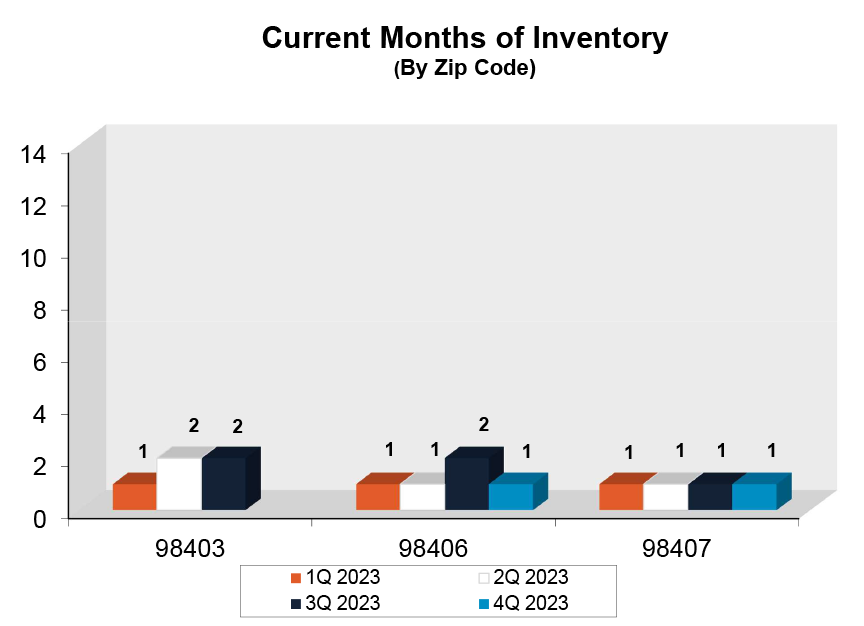

The North Tacoma housing market is still quiet, but our median home price is higher now than it was 12 months ago, due in large part to persistently low inventory levels. In fact, it looks like we’ve regained almost all of the value that we lost during the market correction of late 2022 and early 2023. If interest rates begin dropping in 2024 as expected, we’ll likely see an uptick in sales activity, but we think home values will remain fairly flat through the year.

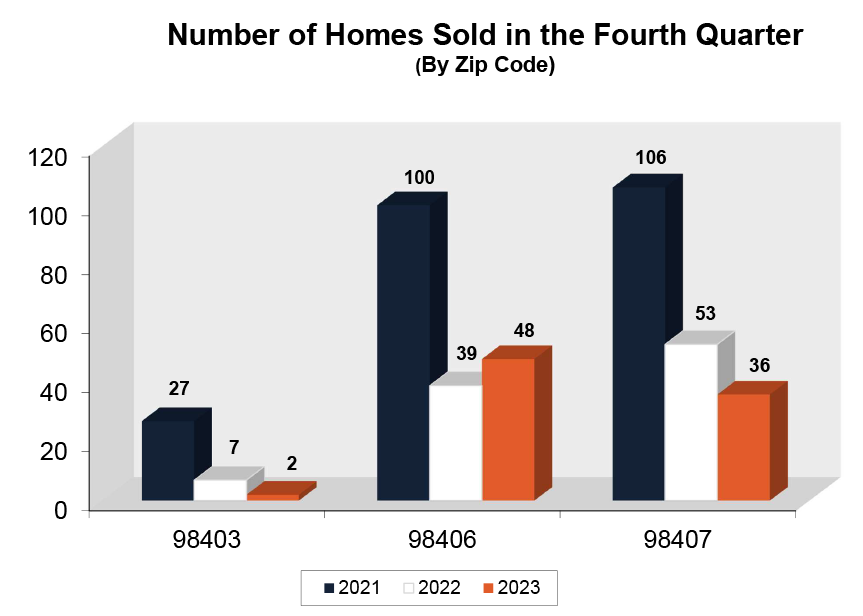

The North Tacoma housing market has been incredibly quiet lately. Only 86 single family homes were sold in zip codes 98403, 98406 and 98407 in the fourth quarter of 2023 – a 15% decrease in sales activity when compared to the fourth quarter of 2022 and a whopping 63% decrease when compared to the fourth quarter of 2021. If you can believe it, only two houses were sold in all of zip code 98403 in the last three months of 2023.

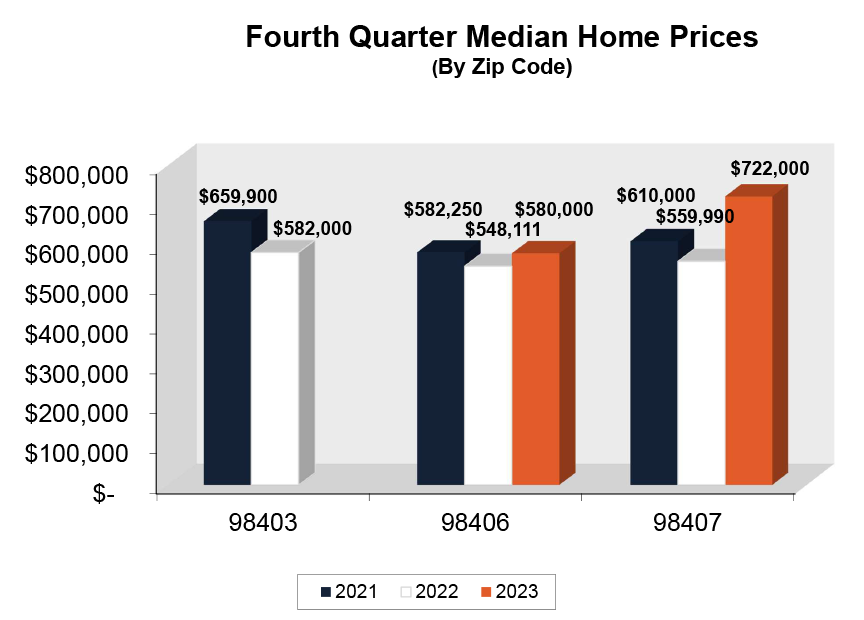

The median home price in North Tacoma has risen to $640,000 - approaching the $650,000 height that we reached right before the market shifted in the spring of 2022. Homeowners are glad to have regained the lost equity, but housing affordability is becoming increasingly problematic for buyers. According to a recent New York Times article, only 2.3% of the homes available for sale in Tacoma are affordable for the median wage earner here (compared to 16% of homes nationwide).

Most economists predict that the Fed will cut interest rates at least two or three times in 2024, which should help to ease the affordability issue to some extent.

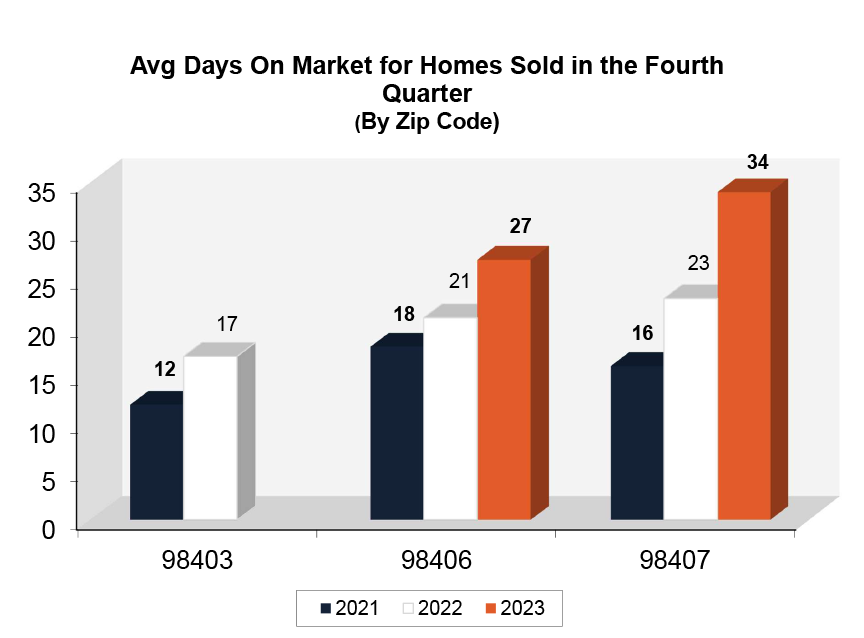

On average, it took about a month for North Tacoma homes to move from active to pending in the fourth quarter of 2023 – twice as long as it did before the market shifted in 2022.

Current Market Conditions

-

- Windermere economist Matthew Gardner predicts that mortgage interest rates could fall as low as 6% in 2024, depending on when the Fed makes cuts, how often and by how much. Rates are currently hovering around 7.5%. Gardner also predicts flat prices in 2024 and a modest uptick in sales activity.

- National Association of Realtors chief economist Lawrence Yun also predicts a flat market in 2024, but he’s more optimistic about sales activity, predicting a 13.5% increase this year.

- Redfin chief economist Daryl Fairweather’s predictions are more conservative. She believes we’ll see a slight drop in home prices in 2024, in response to increased inventory levels, and that mortgage interest rates won’t go below 6.6% before 2025.

- Redfin also predicts a wave of boomerang migration as remote workers are forced to return to the office in greater numbers, many in tech-centric metro markets like Seattle. That bodes well for local housing trends.

- News outlet Axios reports that Seattle is 9th in the nation when it comes to cost of living, making it more affordable than New York and San Francisco but less affordable than Denver and San Diego

In the current real estate marketplace, it remains critical for buyers and sellers to seek expert advice. If you’re thinking about buying or selling a home in the area, please contact us to discuss how we can put our knowledge and experience to work for you.

Mark Pinto is a top-producing Realtor with Windermere Chambers Bay, specializing in residential real estate in Tacoma, Gig Harbor, University Place and Lakewood.

Mark Pinto: (253) 318-0923

MarkPinto@windermere.com