First Quarter Market Update for North Tacoma

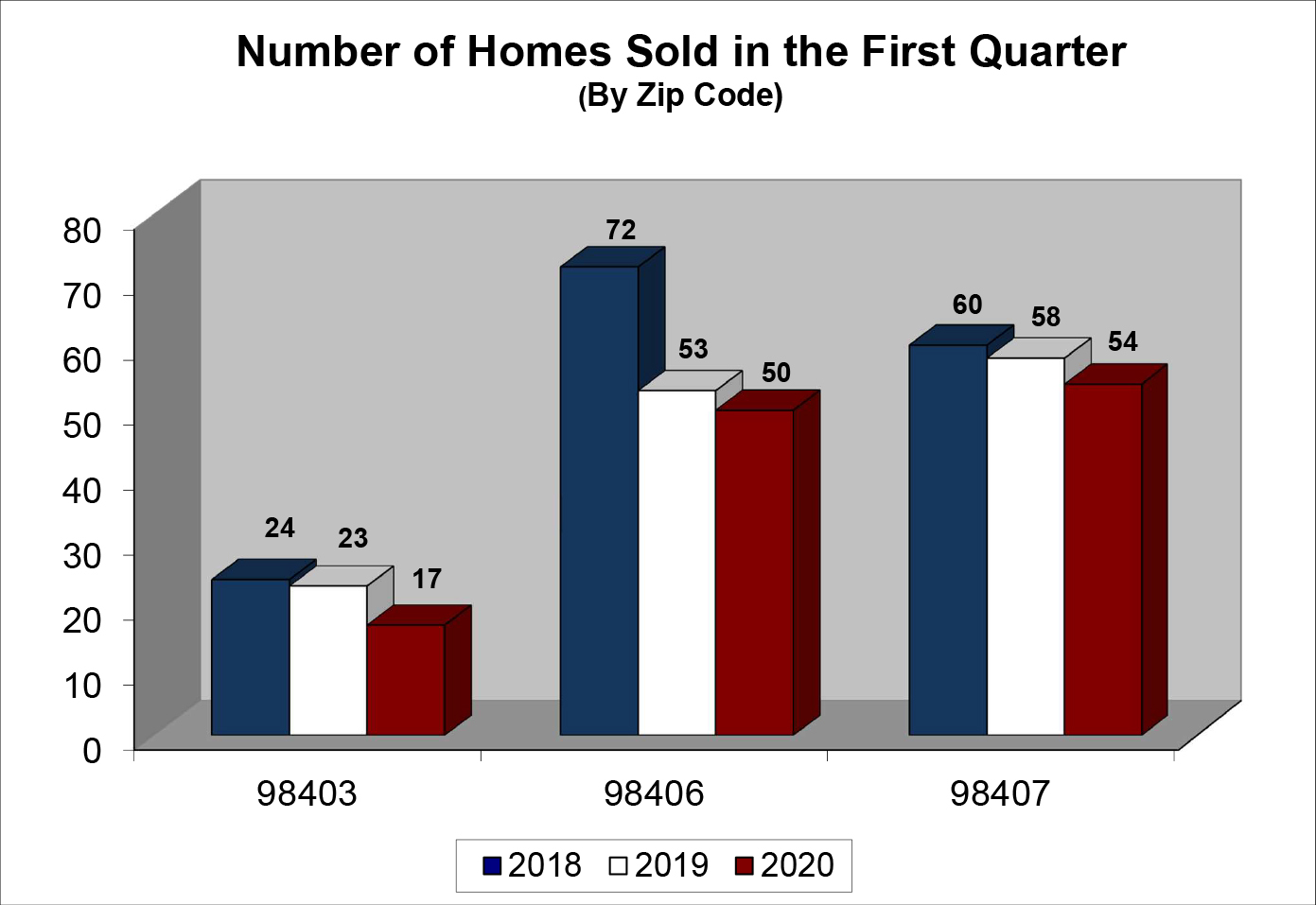

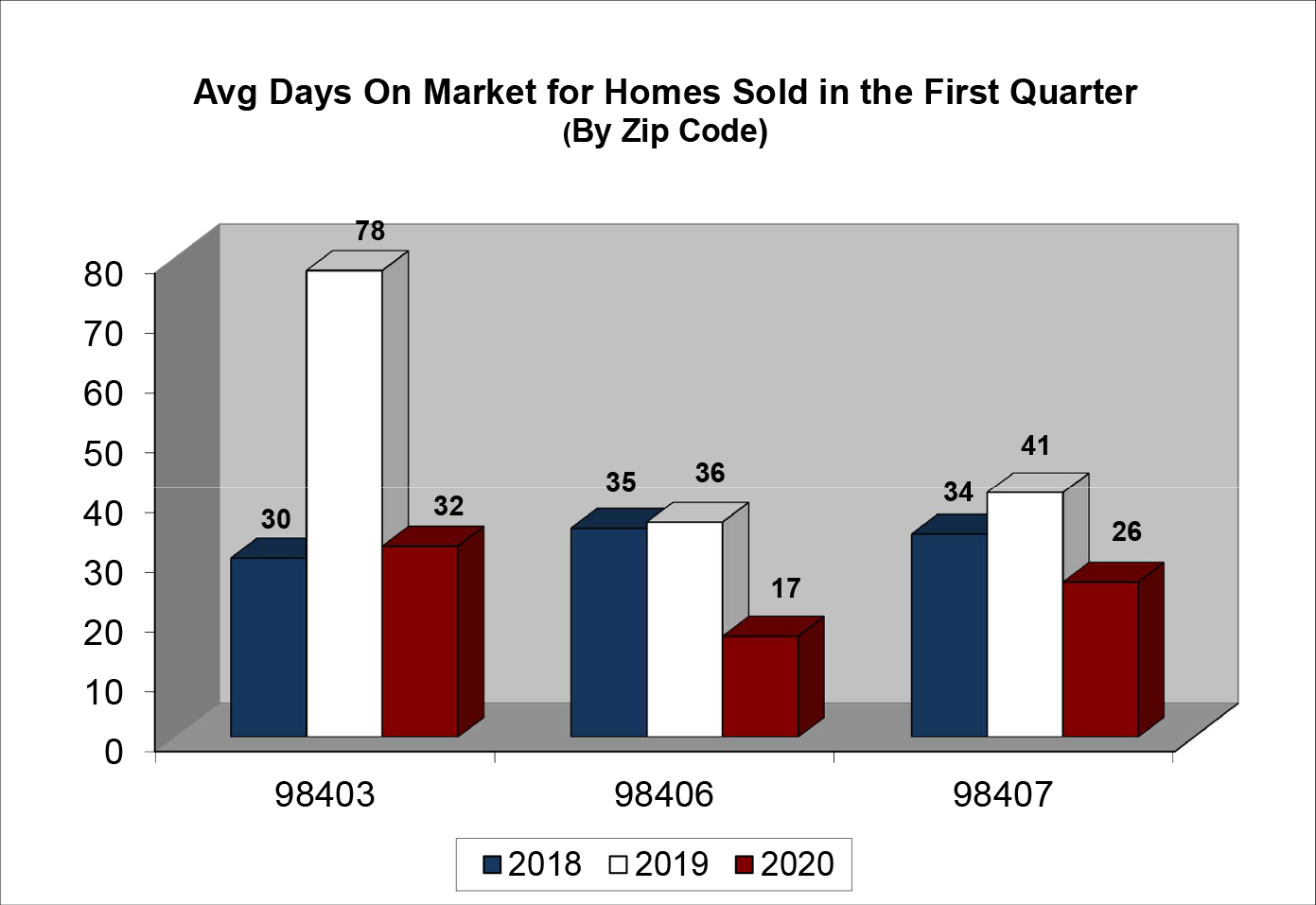

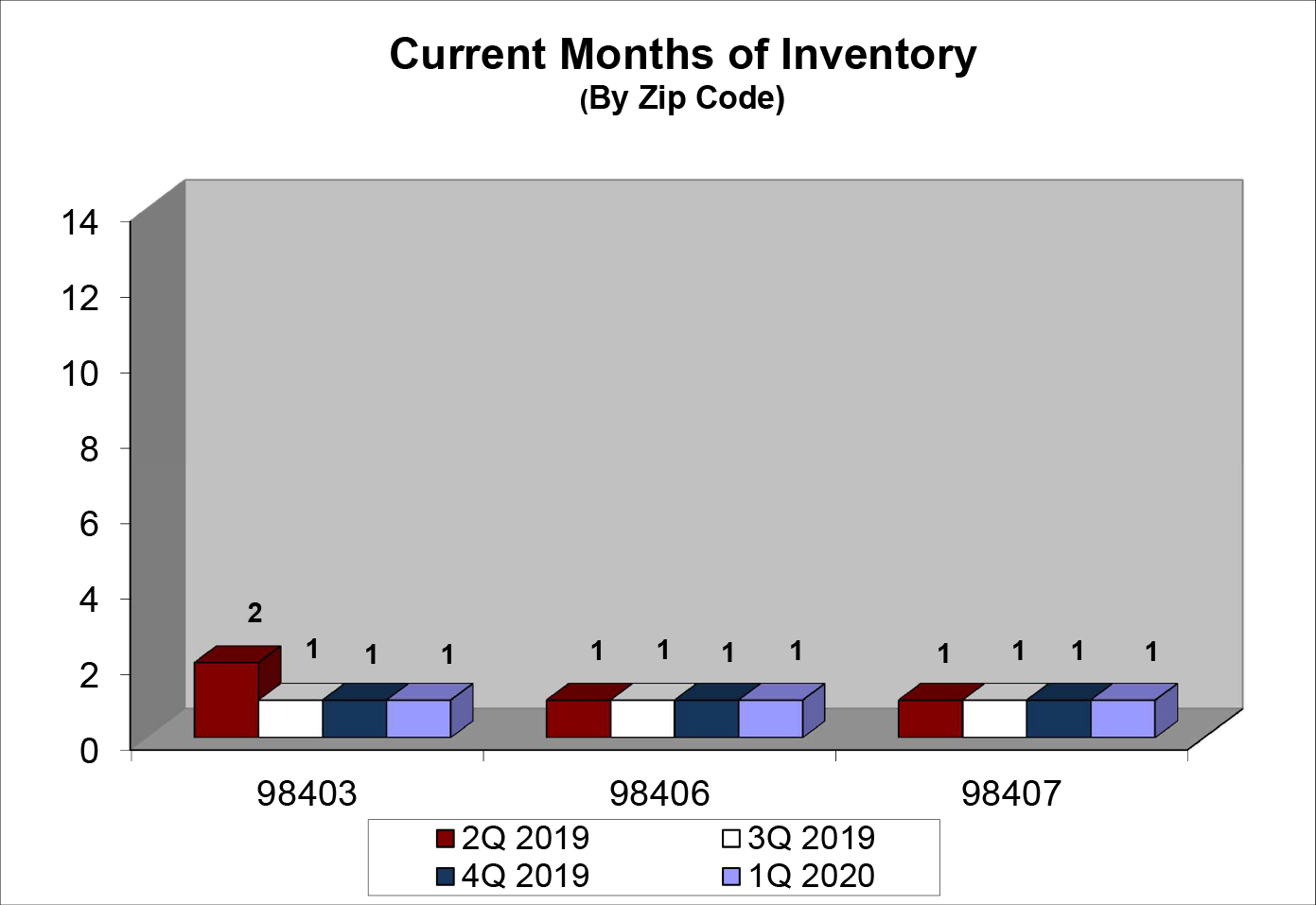

The pace of the market continues to quicken. On average, homes have been selling in 3-4 weeks. Inventory levels remain extremely low. Unless available inventory increases dramatically during the COVID-19 pandemic, pent up demand should help to stimulate the market when things return to normal.

What’s happening with the broader economy?

|

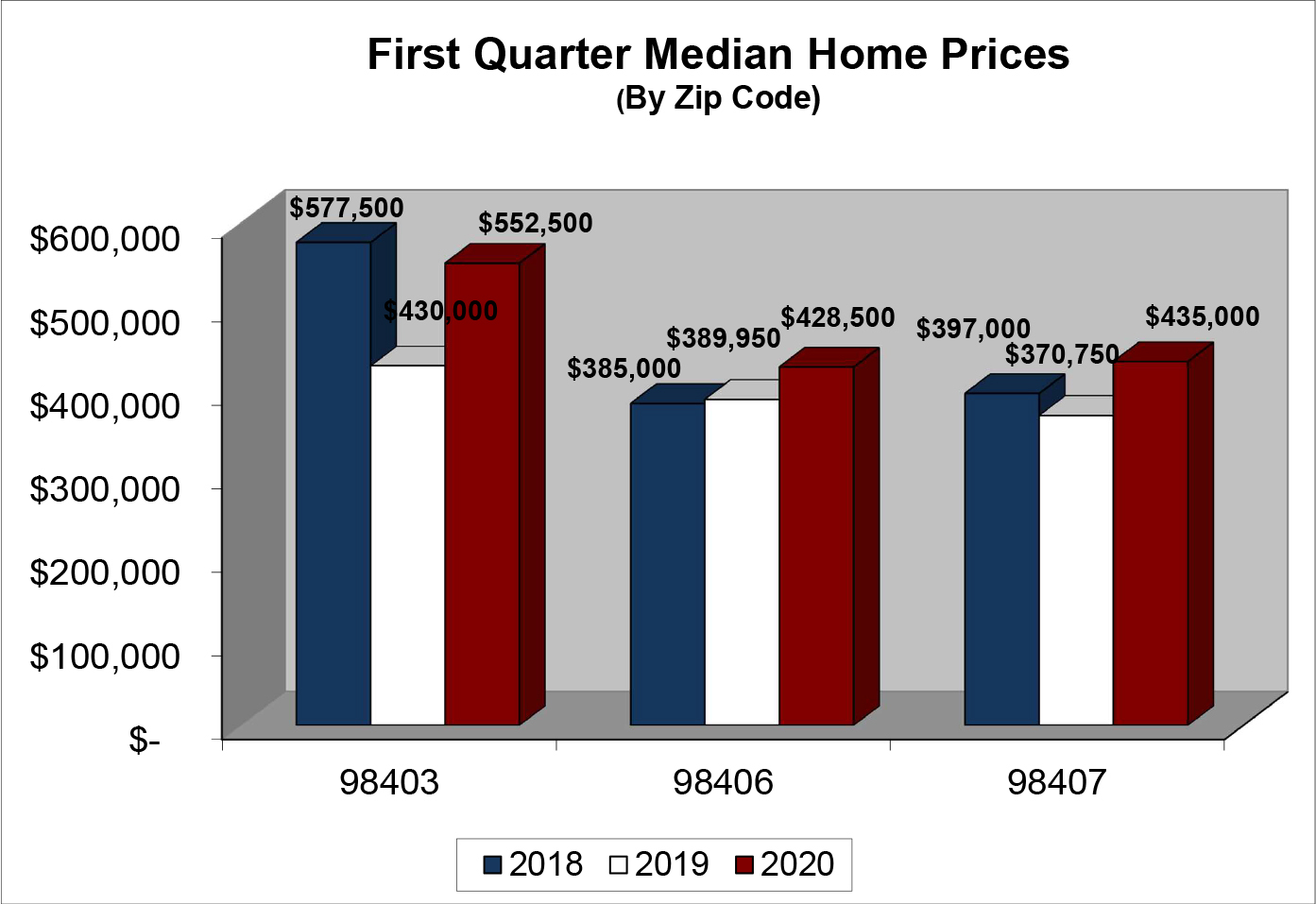

What impact will the pandemic and associated recession have on home values? That remains to be seen, but we’re guardedly optimistic.

|

|

Because the housing market was strong when the COVID-19 pandemic began and because the federal government has implemented measures to keep the housing market strong as we head into a recession, we’re guardedly optimistic that home values will remain stable. If we do see a drop in home prices, that drop should be modest.

Given the uncertainty associated with the current health crisis, it’s critical for buyers and sellers to seek expert advice. If you’re thinking about buying or selling a home in the area, please contact us to discuss how we can put our knowledge and experience to work for you.

Mark Pinto is a top-producing Realtor with Windermere Chambers Bay, specializing in residential real estate in Tacoma, Gig Harbor, University Place and Lakewood.

Mark Pinto: (253) 318-0923

MarkPinto@windermere.com