Is Another Foreclosure Crisis Looming?

Many of us remember the housing crash of 2008 and the slew of home foreclosures that occurred. As we navigate our way through the current recession, it might be tempting to predict that history will repeat itself with another housing crash fueled by a wave of home foreclosures. Homeowners are definitely struggling right now, but that doesn’t necessarily mean that we’re going to see a significant uptick in foreclosures in 2021.

1. Loan Forbearance

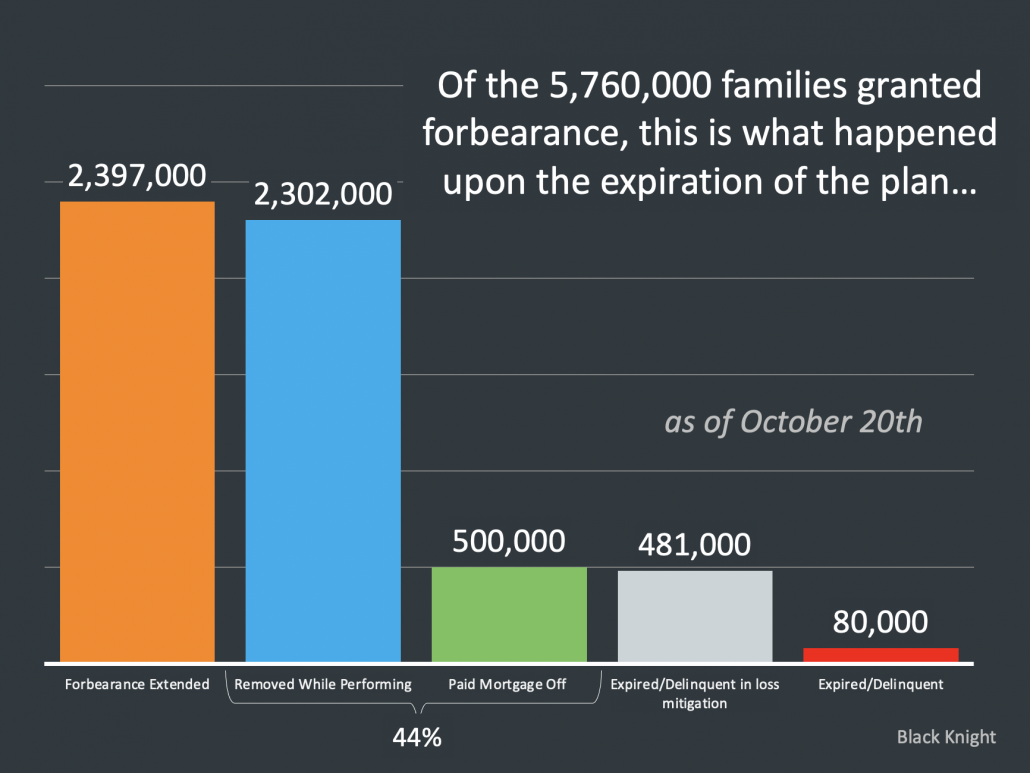

The federal government has responded very differently to the current economic crisis than they did in 2008 by implementing a home loan forbearance program that allows many borrowers to suspend their monthly loan payments until their economic circumstances improve. Almost 6 million borrowers have taken advantage of this program.

By the time the initial phase of the forbearance program ended, many of those borrowers had chosen to pay off their mortgage or discontinue forbearance because they found they were able to continue making their monthly mortgage payments. Less than half of borrowers initially in forbearance chose to extend forbearance, and only 80,000 borrowers (just 1.4% of borrowers in forbearance) chose to move towards foreclosure.

2. Home Equity

The pandemic and the associated financial crisis are far from over. Foreclosures will almost certainly increase in 2021, but there’s another element in play that will help to temper that increase. Equity.

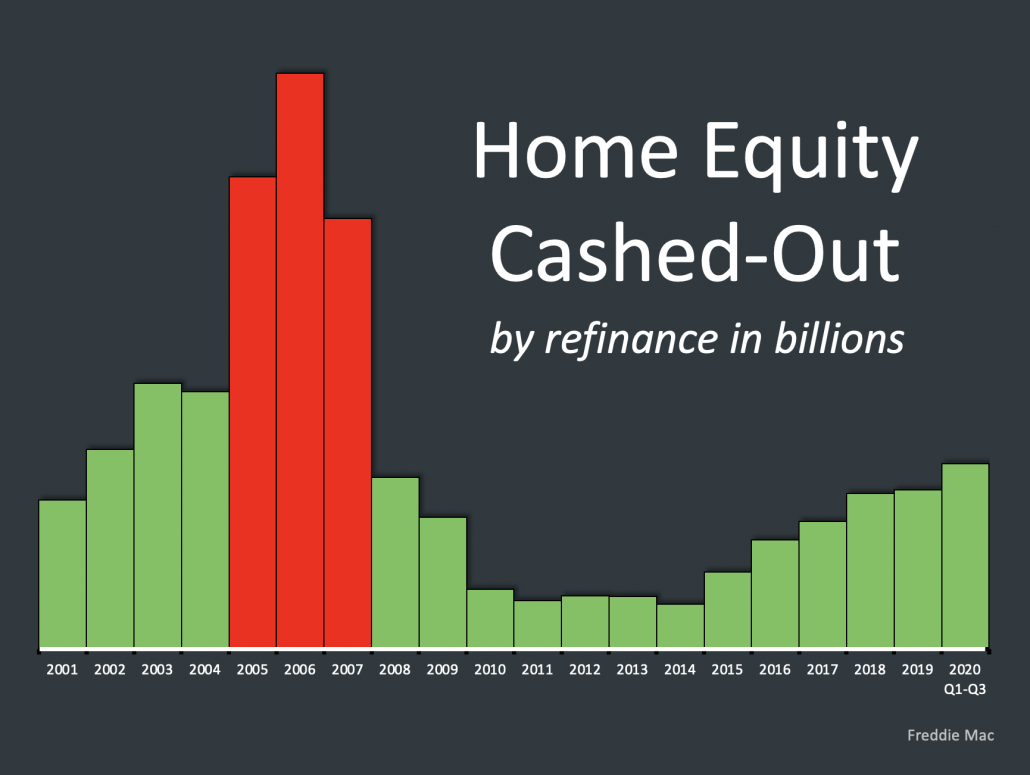

A lot of homeowners pulled equity out of their homes as cash for discretionary spending in the years leading up to housing crisis in 2008, which limited their ability to sell their homes when the housing market tanked and/or their economic circumstances changed.

Homeowners are still tapping into home equity for spending purposes, but current levels of borrowing are MUCH lower than they were in 2006 and 2007.

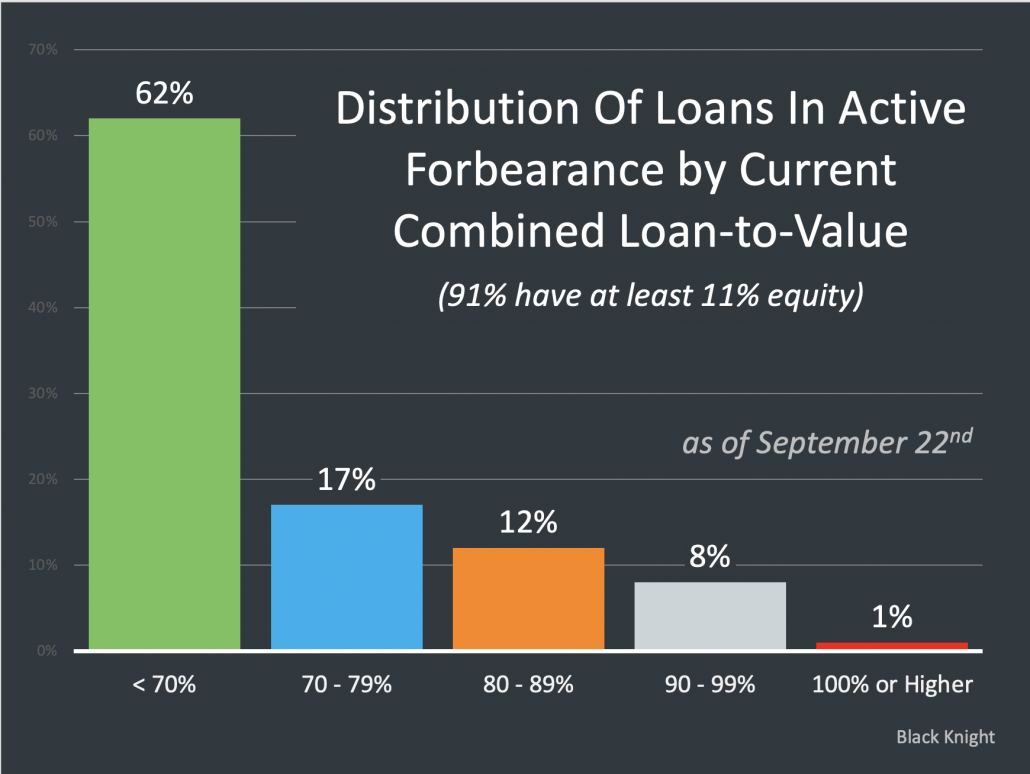

As a result, the large majority of borrowers currently in loan forbearance have quite a bit of equity in their homes – more than enough to sell if they need to and still put a little money in their pockets. If you’re currently in loan forbearance and curious about your options, let us know. We’d be happy to discuss.

The picture looks pretty reassuring now, but what happens when loan forbearance programs end and borrowers have to catch up on deferred payments? Lenders will establish repayment plans, ideally deferring some portion of the missed payments by extending the life of the loan. Many borrowers will be able to meet the demands of a repayment plan, but some will not, particularly those who’ve lost their jobs due to the economic downturn. Fortunately, most folks who aren’t able to start making their loan payments when forbearance ends will have the option to sell.

Some increase in foreclosures in 2021 is inevitable, but the increase should be relatively modest for the reasons noted above. And because housing inventory levels are so incredibly low right now, it would take a lot more than a modest increase in foreclosures to shift the housing market in a noticeable way – so a foreclosure crisis seems unlikely in 2021.

Mark Pinto is a top-producing Realtor with Windermere Chambers Bay, specializing in residential real estate in Tacoma, Gig Harbor, University Place and Lakewood.

Mark Pinto: (253) 318-0923

MarkPinto@windermere.com